Explain Different Approaches to Working Capital Management

This approach classifies the requirements of total working capital into two categories. Under this approach the funds for.

Strategic Management 9781572225794 Business Planning Leadership Management Operations Management

One of the most important working capital components to be managed by all organizations is cash and cash equivalents.

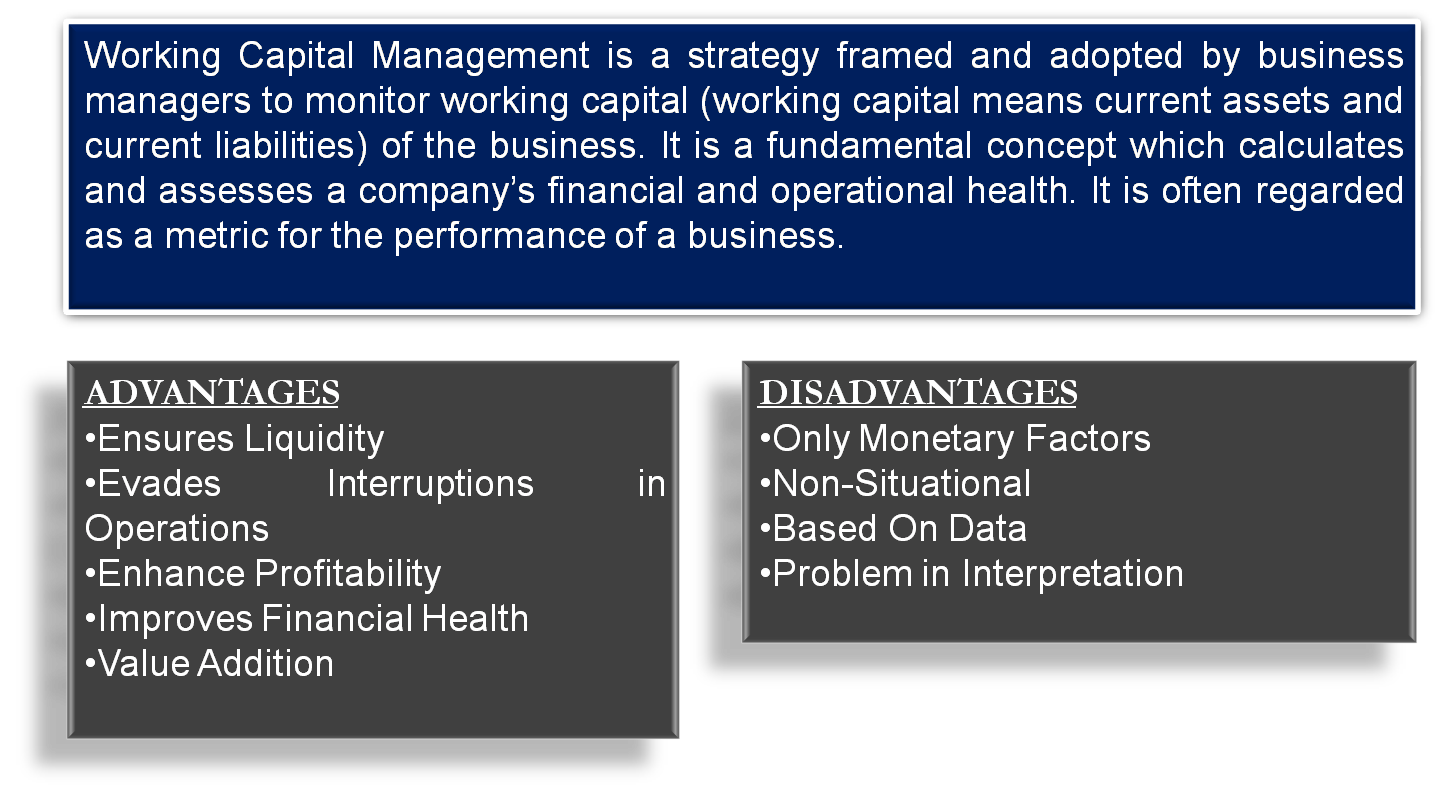

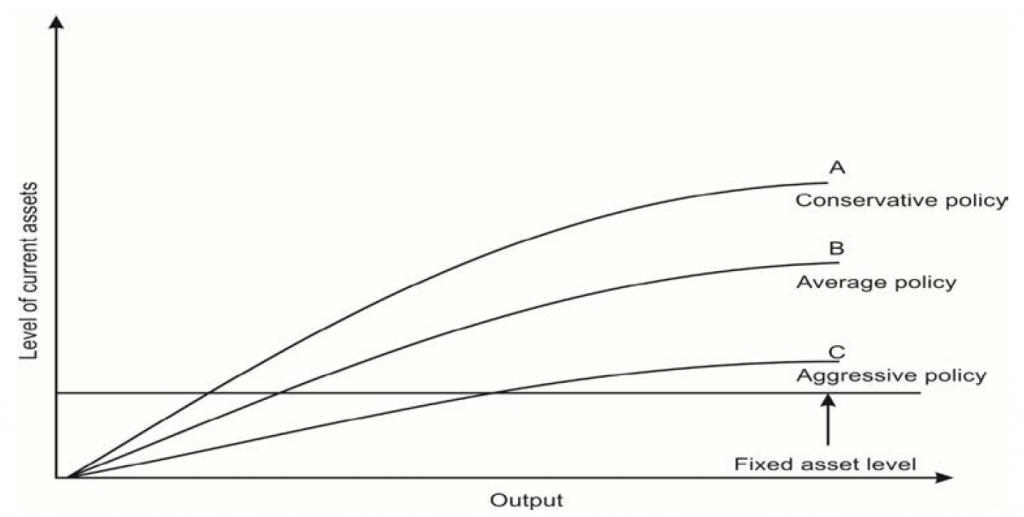

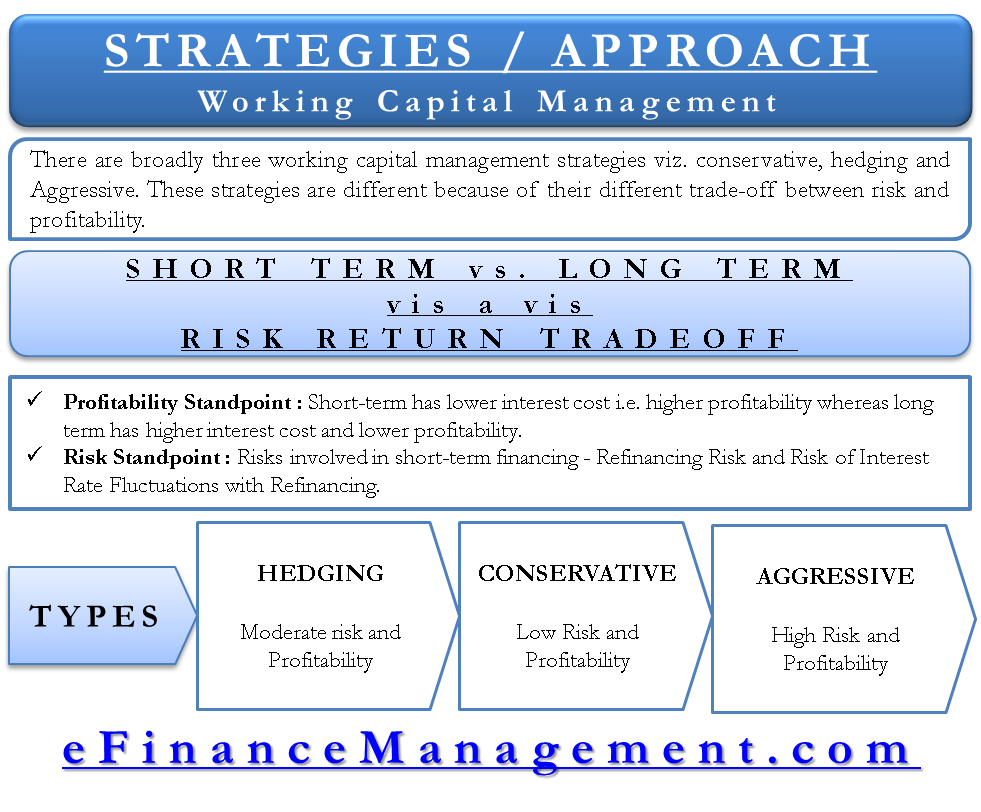

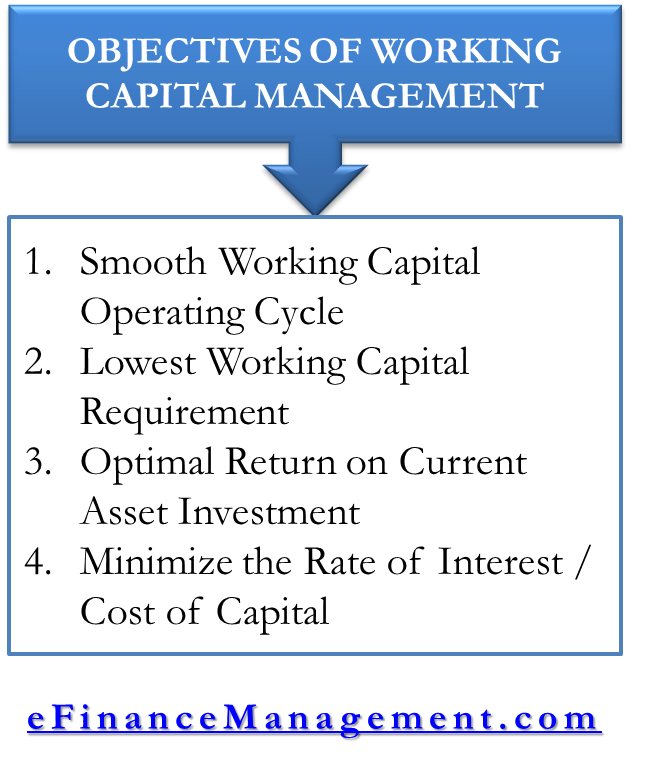

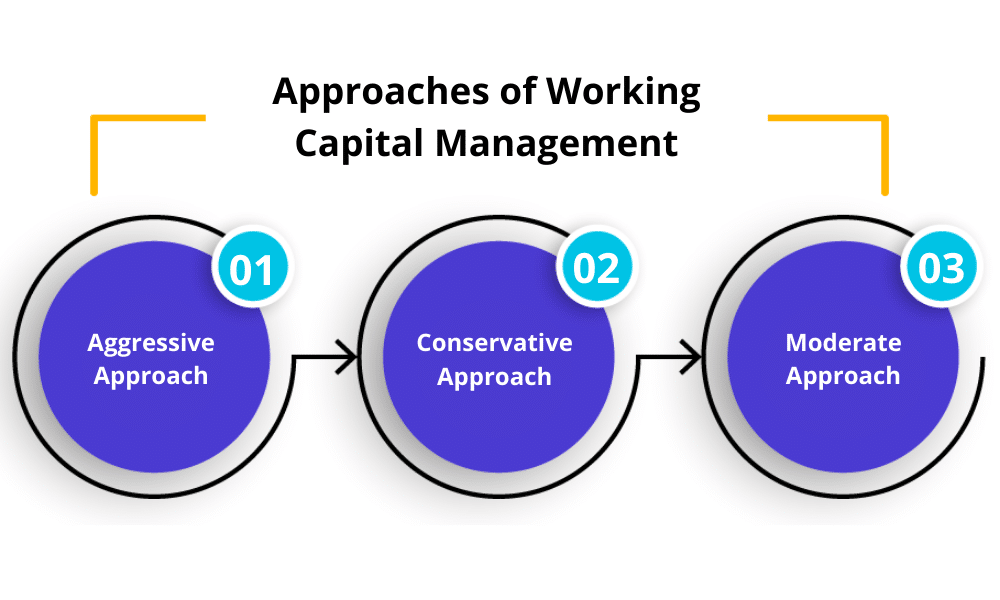

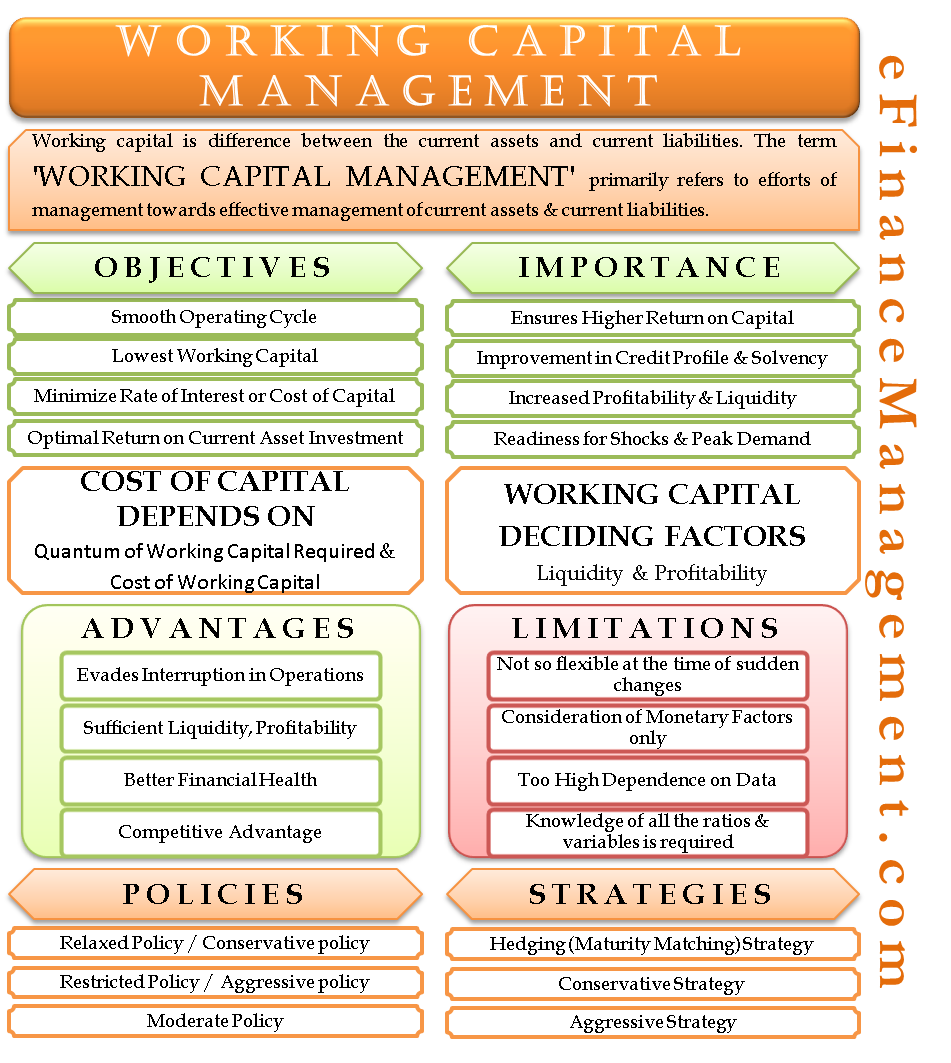

. Working capital management should always ensure that the business has enough liquidity to meet its short-term obligations often by collecting payment from customers sooner or by. Working capital management involves balancing movements related to five main items cash trade receivables trade payables short-term financing and inventory to make. In a conservative approach interest cost is higher compared to the other two working capital policies.

Thus naturally it lowers profits. Working capital needs will vary depending on the type of the business and its. A Cash and Cash equivalents.

Therefore the goal of working capital management is to manage a business current assets and current liabilities in such a way so that a satisfactory level of working. Working capital management is a business strategy designed to ensure that a company operates efficiently by monitoring and using its current assets and liabilities to their. The hedging approach is also known as the matching approach.

Working Capital Management Strategies 1. This financing gives you the cash you need to keep things moving while you wait for outstanding. Thus naturally it lowers profits.

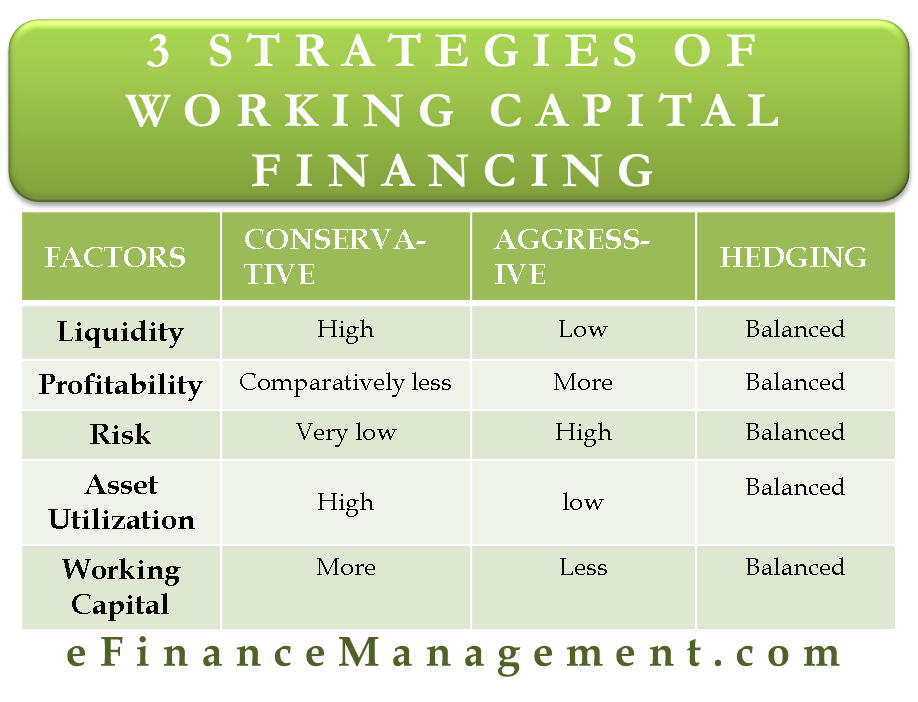

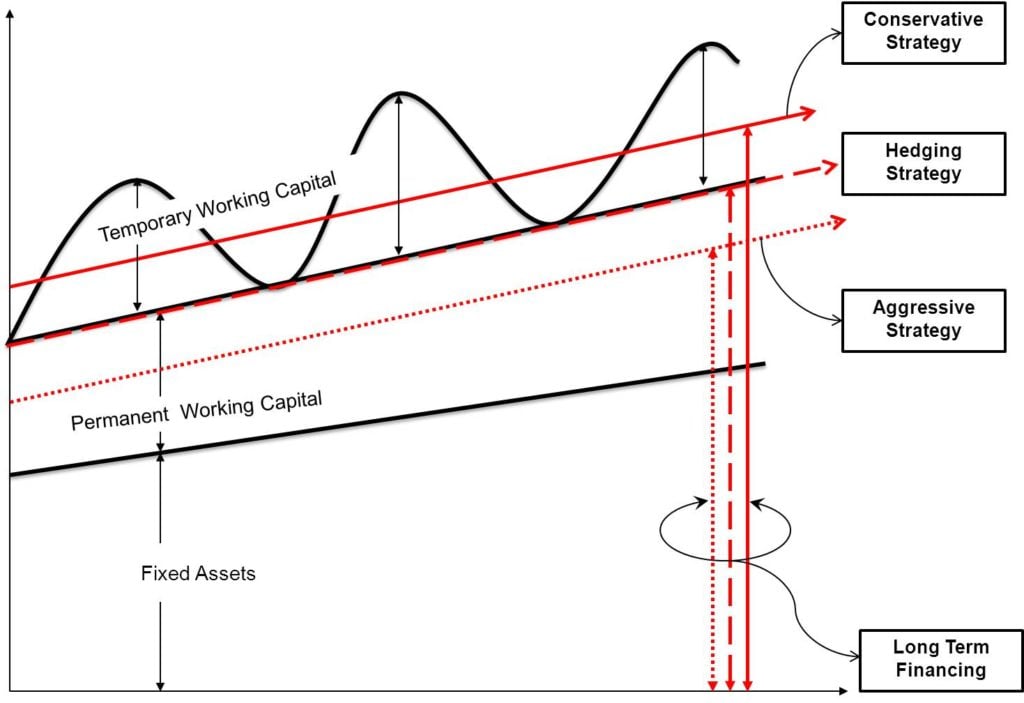

3 Strategies of Working Capital Financing. Working Capital Management Strategies Approaches. A conservative strategy suggests not to take any risk in working capital management and to.

There are broadly 3 working capital management strategies approaches to choose the mix of long and short-term. One method to help with this issue is through working capital financing. The Importance of Working Capital Management.

Approaches to Working Capital Financing Understanding the Needs of the Business. There are three strategies or approaches or methods of working capital financing Maturity Matching Hedging. Upon completion of this chapter you will be able to.

This approach suggests that in addition to. Explain the objectives of working capital management in terms of liquidity and profitability and. Working capital is a daily necessity for businesses as they require a regular amount of cash to make routine payments.

I Permanent or fixed working capital which is the minimum amount required to carry out the.

What Are The Approaches To Working Capital Management Enterslice

Chapter 7 Working Capital Management

Working Capital Management Strategies Approaches

Aggressive Approach To Working Capital Financing Financial Strategies Budgeting Money Budgeting Finances

Ten Types Of Innovation Disruptive Innovation Innovation Strategy Business Innovation

Objectives Of Working Capital Management

Compare 3 Strategies Of Working Capital Financing

The Ways Of Working Canvas Project Management Tools Business Model Canvas Management Skills

What Are The Approaches To Working Capital Management Enterslice

Innovation S Globalization With Deloitte Innovation Management Types Of Innovation Innovation Strategy

Hr Analytics And Big Data Work Big Data Make Business Analytics

Chapter 7 Working Capital Management

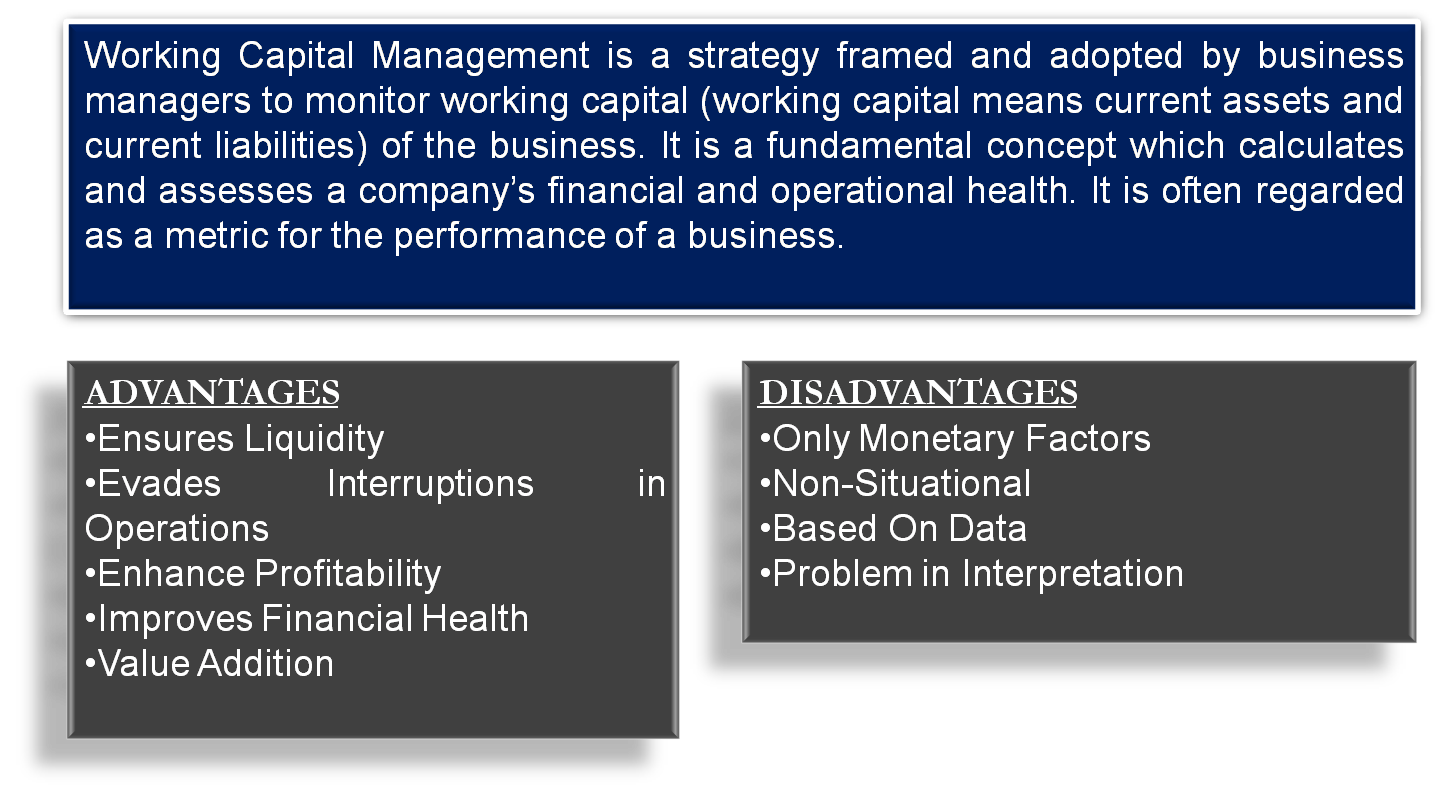

Advantages And Disadvantages Of Working Capital Management

Chapter 7 Working Capital Management

Creative Destruction And Innovation Innovation Innovation Management Marketing Innovation

What Are The Approaches To Working Capital Management Enterslice

Working Capital Management Strategies Approaches

Working Capital Management Meaning Goals Strategies Policies Etc

Comments

Post a Comment